Governor Hochul’s recent address left property tax reform off the agenda, frustrating many New Yorkers facing unfair tax burdens.

New York City: It’s January, and homeowners are bracing for those property tax bills. We all know what that means—watching the mailbox with a mix of dread and hope.

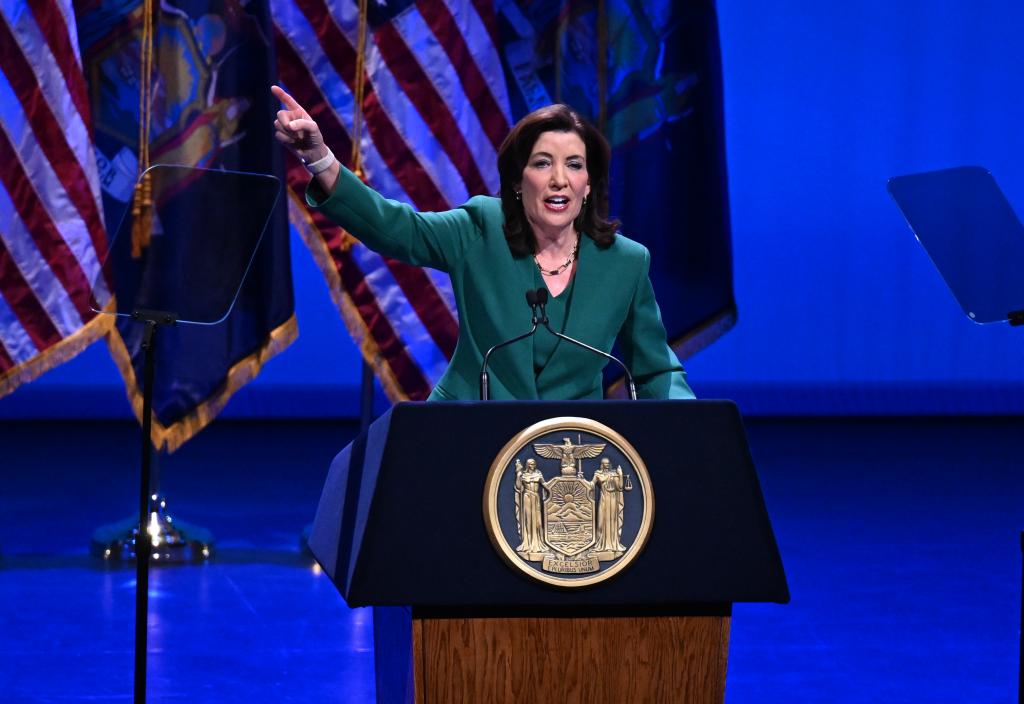

On Tuesday, Governor Hochul dashed our hopes again. Her State of the State speech didn’t mention property tax reform, leaving many of us feeling frustrated.

Since 2018, the Property Tax Reform Commission has been pushing for changes to make our tax system fairer and simpler, but nothing has happened.

It’s pretty wild how unfair our property tax system is. Even the City Council’s Democrat Finance Chair and the Republican Minority Leader agree on that!

We’ve got a state cap on assessed value growth that hasn’t changed in nearly 40 years. This means homeowners in different neighborhoods pay wildly different rates.

For example, a working-class family in a $700K home in Bay Ridge might pay three times the taxes of a wealthy family in a $5 million brownstone in Manhattan. How is that fair?

There are also quirks in tax classifications that hit working-class co-op owners harder than single-family homeowners, while luxury condo owners often get the best deals.

It’s all so complicated that it feels like it’s designed to confuse us. Most New Yorkers don’t really understand how it works, and it’s not because we’re not trying.

The good news? We can change this. We can phase out those outdated assessed value caps and make sure taxes reflect actual home values.

We can also create a new classification for lower- and mid-value co-ops and condos, so they don’t bear the brunt of the tax burden.

And we need to make tax calculations clear and easy to understand for everyone.

But here’s the catch: these changes need to come from the state Legislature in Albany. We can’t just sit back and wait for them to act.

That’s why the city has been pushing for these changes, advocating for a list of 10 recommendations since 2021. But those ideas have just been sitting there, gathering dust.

We got so tired of waiting that we managed to pass the first property tax rebate in nearly 20 years back in 2022!

We’re fed up. It took years to get everyone on the same page, and now we can’t afford to wait any longer while we battle with the state.

We know property tax reform can feel like a distant dream, but it doesn’t have to be.

Every candidate running for mayor should be talking about how they’ll finally deliver real property tax reform to New Yorkers.

No politician in 2025 can claim to care about affordability without addressing this issue head-on.

If New York is serious about fairness and equal treatment, 2025 has to be the year we get it done. The plan has been ready for years.

Joe Borelli is the minority leader of the New York City Council. Justin Brannan, a Democrat, represents Southern Brooklyn in the City Council.